Stratford residents agree to increase taxes for long-term projects

The City of Stratford PEI had $2 million available to fund various long-term projects. But the cost of financing and operating identified new facilities and offering more programs and services exceeded the $2 million available. Ethelo helped the City include residents in a discussion about which facilities they supported most, and whether they’d be willing to pay more taxes to make their priorities a reality. Stratford learned from a representative sample of the community that people were willing to contribute more tax dollars to pay for projects they valued. And city council was able to pass a budget that included tax increases aimed at funding long-term commitments residents supported.

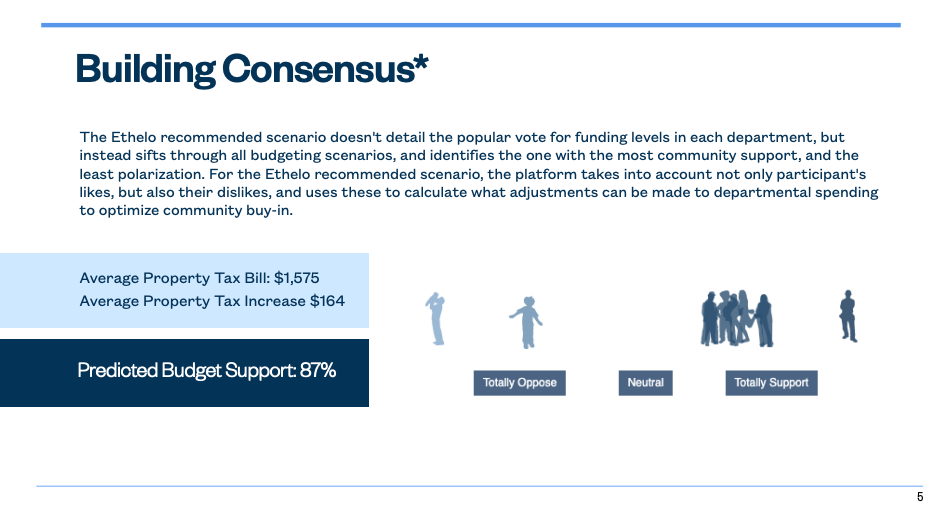

87%

Decision Score

$164

Avg. Property Tax Increase

Stratford is a fast-growing community with significant demand for additional infrastructure, programs and services. The Town developed a 10-year financial forecast based on growth projections and current tax rates. It determined that it would have approximately $2 million per year to fund additional programs and services by the end of the 10-year period. The cost of financing and operating identified new facilities and offering more programs and services exceeded the $2 million available.

The Town needed to understand which facilities, programs and services were most important to residents to prioritize the spending of the $2 million available and whether or not residents were willing to pay more taxes for additional facilities, programs and services.

They used Ethelo to include residents in the discussion and understand where people stood on spending for new facilities. The online Ethelo engagement let taxpayers identify which facilities they thought the Town should build, and how much more tax they would have to pay to make their priorities a reality.

“This was a great way to engage our citizens in a dialogue about long term spending priorities for the Town, which Council and staff used to inform important decisions about future capital and operating investments.” – Robert Hughes, CAO – Town of Stratford

Participants could enter their property values and see how much they were currently paying in taxes. Then they voted on projects they liked until they hit the $2 million mark. If they added any more projects beyond that, they could see their tax bill increase accordingly. So they could make trade-offs between projects they liked and how much more tax they were willing to pay. They could also indicate if they were willing to help with fundraising for the projects to offset any tax increases.

About 975 people participated, or about ten per cent of the Town’s population. The Ethelo data clearly showed that Stratford residents were willing to accept tax increases to fund long-term investments in several key projects.

Industry: Municipal Government

City size: 9,700 residents

Location: Canada

Project type: Facilities and Infrastructure

Schedule a free consultation with an engagement expert