Developing impact investment tools using group wisdom and real-world contraints

Developing an effective impact investment tool requires careful consideration of the trade-off between impact and financial return. In this joint project, more than 600 participants designed their favourite investment vehicle, balancing real-world factors such as risk, return, impact and term – to find an optimal financial product – for themselves, and for the institutions.

6 key

performance indicators

>1000

comments

CEO, Rhiza Capital

Credit unions have long been an example of democracy in the financial world. They are member-owned and operated. The Sunshine Coast Credit Union is a full- service financial institution that offers a variety of banking and investment options to its members.

The credit union partners with Rhiza Capital to invest its members’ funds and sought input on how best to enter the realm of impact investing. Rhiza Capital CEO Brian Smith knew that Ethelo would be the best tool for obtaining that feedback.

Smith has known Ethelo Founder and CEO John Richardson for years and Rhiza has invested in Ethelo so he knew what it could do and the power that comes from group decision making. Beyond that personal relationship, he thought this would be the perfect project for trying it out.

“A credit union is a democratically-owned institution, so it made a lot of sense to use a piece of democracy technology to advance a credit union,” Smith said.

“If an investor is expecting a financial return of say 10% or greater they may not be able to expect a big social impact,” Smith said. “Those tradeoffs needed to be incorporated into the design.”

The consultation began with a survey that captured profile information from each participant. It then asked users for their preferences on factors including:

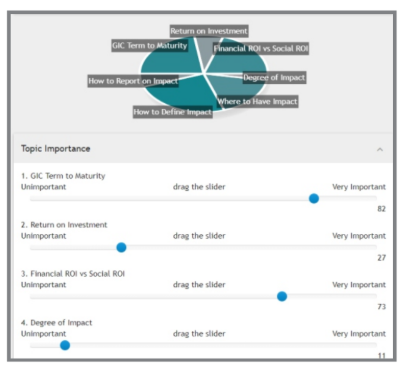

Return on investment Level of risk Length of investment Amount of impact What type of causes funds should support How impact should be reported In real life, each of these factors impacts the others, and the set up in Ethelo was no different.

The Ethelo consultation included a visual representation of those preferences that changed as new information was added. The trade-offs came into play at the end of the process when users ranked the importance of each investment topic.

In the end, each user received a snapshot of his or her ideal investment mix, while Rhiza Capital Management received a broad look at credit union member preferences.

To save time on recruiting panelists, Rhiza utilized a company to recruit participants for the consultation. Ethelo provided that company with a link to the consultation through a special integration. This is a model that can be implemented on other consultations moving forward.

For Smith, the real power of Ethelo came from data analysis, which allowed the project to move forward quickly once the consultation phase was complete. He was able to go back into Ethelo after the data was entered to adjust the variables behind the questions.

The data itself did not change, but Smith and his team were able to change the parameters to make them more realistic. This is another unique feature that Ethelo brings to the table.

Using Ethelo for this project also gave Smith a better view of the platform’s capabilities and how it could work for him on future projects. He sees the potential for better calculations in real-time as users move through the consultation.

“Now that we have a better understanding of the algorithm and the mechanics, we can do things better next time,” Smith said.

“It worked just the way that I hoped it would. We were able to clarify what respondents were saying and the motives behind it. And, Ethelo did the data analysis for us.”

Brian Smith, CEO Rhiza Capital